Two Additional Hurdles to Oil Independence: Fear of Inconveniences and Tax Aversion June 12, 2010

Posted by Michael Hoexter in Climate Policy, Energy Policy, Green Transport, Sustainable Thinking.Tags: carbon tax, Energy Policy, Oil Independence, rail electrification, Sustainability

3 comments

A couple weeks ago, I sketched out an Oil Independence Plan for the United States that was based on a combined move to more efficient uses of petroleum as well as a much more aggressive move to oil- (and natural gas-) independent infrastructure, than is currently proposed in existing legislation in the US Congress. [Since posting that plan, Craig Severance has written an equally ambitious and more detailed plan which can seen here. I also didn’t reference Boone Pickens’ “Pickens Plan” which is an Oil Independence Plan that relies heavily on natural gas and tractor trailer trucks fueled by natural gas.] The most immediate motivation for such a plan, which we should have embarked upon 35 years ago anyway, was of course the oil disaster in the Gulf as well as the muted and unambitious response to that disaster by the Obama Administration. [There are now rumors that Sen Jeff Merkley may be producing a plan to reduce oil demand in the US which will be announced shortly]

I asserted in that post among other things that planning was a critical missing element in our policy arsenal and that only a plan, and not the cap (cap and dividend, cap and trade) instruments under consideration, would bring the necessary resources to bear in a timely manner. Not only has there been a failure to plan for the demise of oil as our primary transport fuel, there has been a fundamental failure to accept planning as part of the legitimate role of political leadership.

After outlining this plan in the same post, I identified 6 hurdles which President Obama or another future leader of such a plan to radically reduce our oil dependence would face. Those hurdles are:

- Market Idealization vs. Planning

- Deficit Worries and Hysteria

- Balancing the Interests of Stakeholders/Mixture of Public and Private Enterprise

- Many Americans’ Love of Expansive Resource Use

- The Biofuels Distraction

- Corporate Funding of and Influence in Politics

Two additional hurdles occurred to me but I felt these deserved their own post.

Hurdle #7: Unwillingness to Accept Inconveniences (or the Prospect of Inconvenience)

This Las Vegas drive-thru wedding chapel is at one extreme of the love of convenience in consumer society. What in most countries and contexts is a lengthy and demanding process of vetting by and meeting with family and clergy is here simply a trip around a driveway without having to get out of your own personal vehicle. The " March of Convenience" tends to orient us towards a single purpose at one time rather than locate us in a web of social relationships and traditional practices with all the possibilities and constraints that that entails. (Photo: Norman Walsh)

The economic history of the last 100 years in developed nations might be called the “March of Convenience” as activities that used to take hours, like procuring and preparing food or traveling to a nearby city, now take minutes. “Convenience” means the use of a device or the design of a way of life enables desires to be more easily fulfilled. Fossil fuels have had a critical role in powering almost all of the conveniences that we enjoy, either directly in automobiles or indirectly via a partly fossil-energy powered electric grid. Americans have led the way in the “March of Convenience”, adopting consumer devices on a mass scale more quickly than other countries, though in recent years we have lagged in many areas of consumer device adoption.

While Europeans, Japanese, and increasingly others in fast developing Asian countries, enjoy many conveniences that Americans do not (better public transportation for one), the American way of life is particularly dependent both on the automobile and the oil-powered delivery truck because of the structure of our towns and cities and the lack of oil-independent infrastructure. Convenience in America, has come to be defined by easy use of the automobile for either long or short trips to stores, work, and entertainment. The hundred year old trend in real estate development towards sprawl has kept Americans in most locations almost entirely dependent on the automobile. Additionally “just in time” supply of retail and wholesale goods has become a business practice that demands air freight or relatively energy-inefficient trucking transport for many locations that are not located on major rail lines.

The proposed Oil Independence plan as well as, in my estimation, the plan offered by Craig Severance, would involve a period of one to two decades (or longer) within which, for some trips, people might need to sacrifice some time or convenience in order to avoid using increasingly pricey and eventually scarce oil. This might mean waiting for others in a carpool or Internet-brokered ride-share, or taking bus service or using a shared van. It may take 25% or 50% more time to do certain tasks. For some people, the isolation of their cars is far preferable to any contact with others, so the notion of sharing space with others will be considered a major inconvenience. These people will, if they are able, pay a higher price for convenience, as the price of oil is bound to go up either via market forces or taxation or both. Nevertheless, in time, those who prefer self-driven solitary transport and have middle to high income will be able to buy battery electric vehicles or plug-in hybrids.

On the other hand, there are tradeoffs other than cost which eventually may become incentives for others not to use a self-driven vehicle: when one isn’t driving one can work, socialize or read using our increasingly multi-functional mobile communications devices and networks. The provision of workable transportation alternatives is key to the success of any of these plans. While some offer the hope of a “drop-in” solution for oil (a fully-realized battery electric vehicle infrastructure and fleet of tens of millions of BEVs) this is not likely to be scaled up in time to radically reduce our oil demand with no inconveniences. Depending on increased or the same level of convenience is a liability for a serious plan to get off oil before both its depletion, before more deepwater environmental disasters, as well as to avoid climate tipping points.

There are aspects of an Oil Independence Plan that typically will attract more attention and therefore funding, those which usually offer an increase in convenience for many transport users. A TGV or Shinkansen-class high speed rail network (>160mph average speed) (which is just one of the solutions in my and others’ Oil Independence Plans) represents a net increase in convenience over the status quo for most trips up to 500-600 miles. On high speed rail with Internet access, one is offered a more luxurious ride than either in a self-driven vehicle or experiencing the inconveniences of air travel. The less “sexy” 90 or 110 mph freight or passenger rail may be more difficult to “sell” because they do not in their design offer the promise of increased convenience over the status quo for those who are particularly devoted to automotive travel (where traffic isn’t a problem).

Another area where there is a fairly transition is where the charging or battery-swap infrastructure has been built for battery electric and plug-in hybrid vehicles. These will represent at least an equal level of convenience to gasoline powered vehicles for most local trips, though the technology is not as mature as that for electric rail.

Perhaps more frightening to politicians and to anxious consumers is the mere prospect of change of any kind in the relatively pampered automotive lifestyle that we currently inhabit with gas at somewhere around $3.00/gallon. The actual changes involved in an Oil Independence Plan will with time offer net benefits or at least a livable but more sustainable lifestyle but to those who are clinging to the “edge” or to office, any change seems frightening. The attack campaigns by elements of the political Right, by incumbent industries, or others who base their appeals on fear are almost pre-programmed for efforts that even suggest that people should loosen their grip on the steering wheel.

Some of these fears might be premised on a fear of strangers, “other people” in general or class prejudices. The automobile dominated lifestyle has enabled people to live in relative isolation from each other. Becoming used to dealing with and coordinating movement with others may be a challenge for some. . While the prospect of sharing rides or public transit is uncontroversial for some and almost a sign of personal virtue, at least in the way of advocacy, there are many, many Americans who are either horrified by this notion or would, when push comes to shove, resist having to enact these virtues rather than simply advocate them.

As with the other hurdles, leadership and planning are required to overcome this hurdle. Planning is going to be required to provide Americans with alternatives to automobile travel, per expansion of mass transit, as well as funding more novel systems like internet ride sharing or automated pod-cars. Higher gas prices, whether by market forces or by the imposition of taxes would drive the change faster but only a visionary and persuasive leader is going to be able to convince Americans to accept higher fuel taxes. The offense and defense against inevitable attacks from the anxious and the defenders of the status quo is to engage consumers/citizens/businesses in an epic quest to change our way of life and put it on more sustainable basis. The missing element is principled leadership in both speech and example which would ideally come from the President or another national leader. As it currently stands, the Presidency of Barack Obama has not attempted to engage in such a quest; partial or half-hearted movements towards these goals would expose leaders to attack from those who cling fearfully to present satisfactions and our way of life as it stands. The best defense in this case is offense and commitment to a better future.

Especially with a rise in the cost of fuel, businesses used to “just in time” delivery from distant suppliers may need to reconsider their business practices and inventory strategy. Long-distance rail freight may not in the first years be able to reproduce the speed of long-distance tractor-trailer trucks which can choose the most direct routes between supplier and buyers. For local delivery however, the transition to battery power is fairly easy for small and medium duty trucks with shorter ranges.

There are “Peak Oil” narratives, associated with figures like Richard Heinberg or James Howard Kunstler that based on an extreme version of this change in lifestyle, within which society becomes radically localized and many institutions collapse into a friendlier version of the world of “Mad Max”, the 1979 Australian film which portrayed a dystopian future. I don’t share the pessimism of some in the Peak Oil community but their arguments and warnings cannot be dismissed out of hand. With the cautious and unimaginative leadership shown in the last month here in the US, the likelihood of social collapse or at least a radically downsized society (an outcome which some would find a positive development) is higher rather than lower after a peak in oil production.

The largely mythical notion of a painless transition between one industrial and energy-related way of life and the next holds out the notion for policy makers that they just need to wait for innovation to deliver a new technology that offers only benefits and no tradeoffs. Economic historian Jeremy Greenwood chronicles how throughout the last two hundred years the acceptance of technologies that we consider to be superior happened over a period of decades in which there were struggles between interest groups and losses of economic benefits as well as gains from the new technologies. The fantasy of a “drop-in” technological replacement for the internal combustion engine continues to make it difficult for leaders to face hard choices.

Hurdle #8: Tax Aversion and the Retreat from an Ethic of Social Responsibility

The current "Tea Party" interpretation of the 1773 Boston Tea Party is that it was simply a rebellion against "too much" taxation. The more standard textbook interpretation has been that it was a rebellion about "taxation without representation". A more economic historical view was that it was an anti-monopoly rebellion by colonial merchants against the advantages conferred on the East India Tea Company by the British Crown ; the Tea Act of 1773 was actually a tea tax reduction that made the East India tea cheaper than the competition. (Image from John Gilmary Shea, 1886 Story of a Great Nation New York:Gay Brothers and Company)

Another hurdle to oil independence is tax aversion bordering on tax phobia. While, in the previous list of hurdles, I underlined the importance of public finance of transport and energy infrastructure, I left open the possibility that deficit spending would be the primary means of financing this infrastructure. I pointed this out only as a short-term fix during our current deep economic slump. In better times, tax financing will be crucial to keeping deficits and inflation in check. Taxes will need to rise on both the well-to-do and also the middle class as counseled by a growing group of economists that NY Times economic columnist David Leonhardt has grouped in his fictitious “Club Wagner”. Of course tax rates have at times been too high in certain places and times and levied unfairly upon certain activities or groups but now is not one of those times for most tax brackets and taxable entities in the US.

Tax paying and voting are the two main pillars of what ordinary citizens can to do to express a sense of group or social responsibility, the idea that “we are in this together”. Attacking tax-paying in general as an evil in itself, as has become common, is an almost direct attack on a spirit of national or group responsibility. Excessively high taxes can stifle individual initiative but excessively low taxes can fray the ability of a society to meet large scale group challenges requiring government investment. Unfortunately there is no generally agreed-upon economic model of how to set optimal tax rates that accommodates both of these concerns, so tax rates are raised and lowered according to changes in political fashion and power dynamics.

In addition to being a source of funding, the aversive effect of tax is also one of the stronger mechanisms we have to shape our own group behavior via the use of incentives and disincentives. Pigovian, a.k.a. “sin” taxes, are means of limiting the use of resources or engaging in activities which are not illegal but are considered to have high social costs. Many conservative economists prefer Pigovian taxes to income taxes under the rubric “tax what you don’t want”. A significant carbon tax would be one of the most efficient means to limit carbon emissions and fuel taxes of sufficiently high levels curtail the use of various fuels.

To enact significant new Pigovian taxes, these too require a sense of social solidarity or at least a broad social agreement that some activity should be limited at some initial or ongoing monetary cost to society. One of the key weapons we have in reducing oil consumption is to levy higher taxes on oil. Ian Parry of Resources for the Future rightly points out that, like an upstream carbon tax, oil should be taxed at the well-head rather than downstream as a fuel tax. While a upstream carbon tax is preferable as it would include oil, natural gas and coal for addressing GHG emissions, relative to a simple gasoline tax an oil tax has greater coverage as it also would start the search for alternatives to oil in industrial processes and home heating, which makes up 23% and 5% of oil demand respectively.

We have just gone through a 30 year period in the US within which income tax rates have been cut dramatically, particularly on the wealthiest Americans, justified with reference to the largely discredited theories of Arthur Laffer (that tax cuts increase government revenues via economic growth) as well as supply-side, “trickle-down” theories associated with highly influential “Reaganomics” associated with his first budget director David Stockman. The accumulation of private wealth and therefore productive investment was thought to be smothered by the top level marginal tax rates of post-WWII America; by allowing rich people to accumulate more wealth it was thought that more would be invested and the economy would grow. Progressive taxation (the taxation of the wealthiest at a higher rate than the less wealthy) and taxation in general have been treated as taboo and as damaging to the economy since the political triumph of Reaganism. The raising of taxes even slightly became highly politicized as the ideal of a low-taxation, small government society has remained the implicit ideal for politicians in both political parties. Despite the small government ideal, government has continued to grow though often in ways that are not the social welfare driven “Big Government” that the followers of Reagan have attempted to pillory. Furthermore savings rates, one of the advertised benefits of lower taxes, have continued to plummet in the US.

The American economy has grown in this period of low taxation but these increases have come largely in the service sector and particularly in financial services. Low taxation, in combination with a trade policy that undermines domestic production relative to other countries has led to super-consumption, massive increases in private and public debt, trade deficits, investment in and inflation of the value of real estate, and speculative excess in paper assets. The economic booms of the 1990’s and the early 2000’s that low-tax advocates like to point out as benefits of reduced tax rates has come at the expense of manufacturing capacity, at least in the US.

While taxes are never popular, almost no one stands up now in favor of taxes, despite professed concern about deficits. Every politician believes that if they were to be the one to raise taxes, they would lose the next election. With some justification, American taxpayers under 65 feel that they don’t get much benefit from taxes, as there is no comprehensive universal social programs other than for elderly people. The government spends money on an elaborate military, the world’s gendarme, which offers few direct benefits to Americans domestically. American industrial and trade policy has allowed jobs to be off-shored, so the government has not exactly stood at the side of the American worker. President Obama’s health reforms will not be tax-funded with the exception of the expansion of Medicaid, which again biases America’s social spending in favor of distinct disadvantaged groups rather than as a generalized universal principle of social solidarity.

Both the Pigovian side of (oil and carbon) taxation as well as the revenue generation component are critical for a rapid reduction in oil demand. An ambitious leader, I’m hoping President Obama, would have to tackle this by “reversing the ethical valence” of popular perceptions of tax-paying and thereby also some of its emotional valence. To do this, he would need to discuss tax paying as an expression of social responsibility, social solidarity, and responsibility to the future, not merely as a subtraction of monetary funds from one’s perceived economic well-being. To date, the President has tended to reinforce the individualized ethical framework of the low-tax world-view by continual efforts to court those who believe only in individual private initiatives rather than social initiatives. This “pragmatism” continues to undermine Americans’ fragile sense of social solidarity.

Eight hurdles: Too Many?

While six substantial hurdles was a lot, eight hurdles is even more. Is it too much to ask of us, our government and President to meet this challenge?

In my mind, this is the matter of, as mentioned above, a “reality principle” that cannot be ignored, so hurdles must be overcome no matter how many of them exist.

However, the path is somewhat easier than my presentation of these as individual free-standing hurdles would suggest. Many of these hurdles “stand in bunches” or can be surmounted if our leaders adopt a new stance. Leaders attempting to push the US off its oil addiction need to invoke the following general principles, which in turn will allow these hurdles to be taken as groups:

- Re-affirm our sense of social solidarity and social responsibility

- Emphasize social and individual resilience over sensitivity to minor hardships like carbon or oil taxes, hassles of coordinating transportation with others over self-driven automobile centered transportation.

- Affirm the role of government as a tool for the realization of national ambitions and the necessary backstop for market failures

Within this context, many of the eight hurdles become easily surmountable if the “general case” has been made for these principles.

We can reduce our dependence on oil with sufficient coordinated effort. With this effort will come a great sense of accomplishment in an era where it had been thought that this kind of challenge was no longer part of the American Dream.

The Deepwater Oil Spill Exposes a Persistent Failure to Plan and Failure to Lead May 16, 2010

Posted by Michael Hoexter in Climate Policy, Efficiency/Conservation, Energy Policy, Green Transport, Renewable Energy.Tags: Climate Policy, Electric Vehicles, Energy Policy, Oil Independence, Oil Spill, rail electrification

5 comments

The 1969 Santa Barbara Oil Spill catalyzed the environmental movement in the US and inspired some important legislation but did not lead policymakers to take the next step and start the long process of weaning the US from its oil dependency (Photo: Unknown)

President Obama is facing with the explosion of the Deepwater Horizon, a “local” disaster that exposes a deeper, endemic crisis in US energy policy and the US economy as a whole. As he has been in office for still just 16 months, Obama does not bear primary responsibility for this ongoing crisis but he has only recently, a couple weeks after the accident, publicly hinted at the “elephant in the room”: the obvious connection between the undersea oil volcano and our equally obvious need to transition from using oil as our primary transport fuel. Simple reference to the Kerry-Lieberman climate bill that encourages more offshore drilling does not constitute an answer to our oil dependence.

Unfortunately public rhetoric and policy discussions that hinge on the notion of a dependence on “foreign” oil play the role of a “shortstop” in keeping the discussion from going to the heart of the problem. The idea that oil produced on American shores will somehow differentially serve American consumers overlooks the international nature of the oil business with total offshore oil reserves destined never to make much of a difference in the overall price and availability of oil. Estimates put the total reserves of offshore oil in US waters at 18 billion barrels conventionally recoverable and an additional 58 billion barrels “technically recoverable”. While this oil, if extracted, would just be sold on the world market, it equals the equivalent of 11 years of consumption for the US at our current oil consumption rate of 8 billion barrels/year. Subtracting the huge costs of oil spill cleanups and damage, most of the economic benefit of offshore drilling would accrue to oil companies and secondarily to state and federal governments in harvesting royalties, however the latter are going to be left “holding the bag” for the really, really big costs.

To ground this discussion in reality for just a moment, the 2009 US DOE Transportation Energy Data Book attributes to the US 2% of the world’s oil reserves, 8% of production, and 24% of consumption while the rest of the non-OPEC world comes out just a little better at 29%, 48% and 67% respectively. Conventional natural gas is not a much more promising energy source for the future with the US having 3% of the reserves, 18% of the production, and 21 % of the consumption. In the US, transportation accounts for 70% of all petroleum use and 24% for industrial uses. Consumption of petroleum for transportation in the US is 84% for road transportation with around 65% for cars and light trucks and 18% for medium and heavy trucks. Airplanes use 9%, shipping 4.2%, and rail 2.0%. Even if we consumed petroleum and natural gas in proportion to worldwide production, there are credible predictions that we are somewhere in the neighborhood of the worldwide peak in production whether today or in a decade’s time. Even if there were two more decades until the peak and we looked away from oil’s climate and local pollution impacts, would it be justified for our generation to run through this exhaustible resource?

The ballooning US trade deficits are attributable in the last decade approximately 55-60% to outgoing payments for petroleum imports but with the 2008 price spike, oil’s proportion climbed to 65%. With oil prices once again ascending the petroleum related component of the US trade deficit will continue to climb. With the last US trade surplus in 1973, the total US trade deficit has since 2003 stayed in the range $500B to 800B per year.

Turning back to politics, the President, whether by his own inclination or badly counseled by his advisors, has since taking office had a tendency to let the issues be defined for him rather than shaping policy with original view of his own. He has approached health care, financial reform, and climate and energy as though there was some pre-formed wisdom which he simply needs to allude to or tap into in order for the American people and Congress to understand. Erring on the side of being too laid back, perhaps partaking of the Spirit of Aloha, has not always served him well: to get health care across the line he had to shed the “cool customer” image to actually win the votes in Congress.

The apparent rationale for his laid-back approach to issues, so commentators say, comes from overlearning what is considered to be a mistake of the early Clinton White House. Clinton’s hands-on approach to policy is supposed to have alienated Congress and doomed Clinton’s health care efforts. Obama has taken the opposite tack and can claim at least passage of a health care bill, though it is not clear yet how positive an achievement this will be considered when it actually takes effect.

What is missing so far in the Obama Presidency is the President taking the role of educating and perhaps changing the public’s views on important issues, which have been heavily colored by a very strong and organized counter-reform messaging machine. The President has shied away from using the “bully pulpit” and allows Congress, which is considered by the public at the moment to be corrupt and untrustworthy, to shape the terms of the debate.

With the approach to a climate and energy bill this year, post-health care, the President opened up with a tactic rather than with a strategic plan for energy. His announcement in March that he would lift the ban on offshore drilling in parts of the Gulf and the East Coast was a means of gaining support from Republicans for the ever more amorphous climate and energy package which is currently in the Senate. Meanwhile, with so many issues and concerns, it is safe to say that energy is not top-most on most people’s minds in the Great Recession.

But the President has so far treated this as a case of another industrial accident for which liability can be assigned to the owner or commissioner of the oil rig, BP. President Obama has not even advanced to the rhetorical level of George Bush’s 2006 State of Union where Bush declared America “Addicted to Oil”, despite Bush, in action, being responsible for gutting the regulatory agencies that may have prevented the spill. While nominally a more “liberal” President and not from the oil patch, Obama has not presented a tangible vision of a post-oil society and, in combination with his preferred policies and speeches, the public is left mired in the oil-dependent present.

Discussions about who is to blame, who will pay, and what can be done in the Gulf to recover from the spill are important but are ultimately distractions from the most important question:

What will the US do to wean itself from its oil dependency?

In media accounts, the effort to make this a conventional tale of corporate or regulatory malfeasance is becoming the favorite of supposedly hard-hitting television journalists. Yet these interviewers avoid looking into the frightening “maw” of our economy’s fatal dependence on oil. The President is also looking away, focused as he is on technical and regulatory “fixes” for the offshore drilling disaster.

The upcoming climate bill in the Senate is being sold as an effort to reduce our dependency on oil and other dirty fuels but it contains few aggressive provisions to get us there. The just released details of the bill, indicate that it’s mild cap and dividend provisions may slightly raise oil prices (starting in the area of $.10-$.20/gallon and increasing by 3-5% over inflation per year). And offshore drilling provisions are in the current draft, offered now as an opt-out for states that wish to keep the ban in place. As a whole, the bill postpones until the 2020’s any serious moves to cut emissions and focuses on the implementation of coal carbon capture and storage rather than more promising renewable technologies and grid enhancements. Ironically, Senator Kerry has mentioned on TV, as if this were a sign of his seriousness, that he had been working with the oil industry on this bill.

If we assume the best intentions of the President and the Congressional leadership, one single legislative session or bill cannot undo 30 years of negligence and foolish disregard in the area of energy. Whatever his ultimate goals and political commitments as President, Obama, if he endeavored to “do the right thing”, would have a number of hurdles (described below) to overcome. However right now, he, his Administration and his Congressional allies are managing just a few cosmetic moves in the direction of change. On the issue of oil use and oil dependence, the bill and the Administration’s efforts are weak.

I am proposing here a stronger response that deals directly with America’s oil dependency.

A Strategic Energy Plan for Oil-Independence and Carbon Mitigation

A serious effort to get off oil will involve an equal emphasis on battery electric and grid-tied or grid-optional large vehicles like this trolleybus. The de-electrification of public transportation, while greeted by some as progress, now appears to have been a big mistake. (Photo: Adrian Corcoran)

The only solution to our oil dependency and the inevitable disasters that come from a mad rush to extract as much oil as possible from the earth is to create a strategic national energy plan that addresses both our oil dependence and our climate concerns. A plan is required because changes in the transportation and energy system involve the coordination and arrangement in a sequence of certain key activities and infrastructure changes, for which market mechanisms, the current “default” preference for policymakers of both Left and Right, are ill-equipped. Such a plan would also be the occasion for leaders of government to show and exercise leadership rather than look around for a lucky break or well-meaning private actors and companies to step into the breach. Turning to planning is unfortunately now in America a politically fraught move but there is simply no alternative, if we want to have a sustainable economy, whether in the narrow economic sense or the broader ecological sense.

A growing chorus of corporate leaders and former government officials is calling for an electrified, oil-independent transportation system for national defense reasons as well as environmental ones. Recently Bill Ford, chairman of Ford Motor Company made the connection between national security and oil, indicating that Ford’s product roadmap will focus on electric drive vehicles in the future. James Woolsey, former CIA chief under Clinton, has been a long-time advocate of electrification for reasons of national defense.

Other nations are rapidly moving away from oil through plan-based efforts by governments in coordination with the private sector, even as almost every other country is starting from a position of less oil-dependence than the US. The Chinese leadership, as is well-known, is very concerned about the effects of oil shortages and prices on China’s economic development. China is in the process of building an extensive high-speed rail network (to Europe too)and is as well working on developing a lead in the area of battery powered vehicles. President Obama mentioned in a recent speech China’s ambitious rail program as an analogue to his efforts in the US but I believe he knows that there is no comparison between the scale of their efforts and our much modest ones. Japan and Switzerland have almost entirely electrified rail networks and France has the goal of electrifying its entire rail network by 2025. Russia, despite its plentiful oil reserves, has electrified the Trans-Siberian and Murmansk lines of its railways in the last 10 years. Denmark, Japan, France, and Israel all are executing plans to build widespread electric vehicle charge and battery-swap infrastructure. By contrast, US freight and passenger transportation in all modes is almost totally dependent upon oil, leaving the US vulnerable to political and geological disruptions of supply and price spikes (see Alan Drake’s proposal for a comprehensive electrified train system for the US).

Two Pronged Strategy: Efficient Use and Oil-Independent Infrastructure

There are two prongs to getting off oil which also share a common path. One prong is increasing the efficiency of oil use in the US via increasing the person or freight miles traveled per unit petroleum consumed. The other prong is building an oil-independent transport infrastructure and oil-independent vehicles. Investment in routes on the path common to both should be favored over those that commit us interminably to oil.

The dream of a quick-fix, a “drop-in” technological solution that will simply replace oil has proved to be elusive and has so far found little basis in the science of energy. So the proposed solution has a number of parts and involves tradeoffs and some large initial costs. However, the invitation is there to any readers to find a better, presently available solution and publicize it.

Efficient Use:

- Levying a gas tax or price stabilization tax that insures that drivers can plan on a minimum gas price going forward on an ascending schedule. Instead or in addition, a carbon tax or fee would disincentivize coal use as well, though might be supplemented by a gas tax to reduce gas use. (the Kerry Lieberman bill’s cap and dividend provisions will raise gasoline prices imperceptibly in the first few years).

- Enable full use of existing passenger rail and bus transportation infrastructure via adequate funding to increase schedules, keep current fare levels. Determine via market surveys and statistics optimal service levels for each route.

- Encourage shared ride and shared vehicle programs and services using Internet and mobile phone resources to coordinate and develop ride-sharing social networks

- Mandating idle-stop systems (a.k.a. “mild hybrid”) on all new trucks and cars as of 2013. Comprehensive idling reduction program at all truck stops, including incentivizing “shore power” electric hookups and retrofit kits. Mandate Cold ironing facilities at all shipping berths by 2015.

- Incentivize Transit Oriented Development via federal incentives for zoning changes at the local government level and developer and homeowner tax incentives.

While focusing on efficient use alone seems “pragmatic”, it actually does not have nearly the appeal and long-term economic stimulative effect of building an infrastructure that moves passenger/driver miles and freight ton-miles off of oil permanently. To focus on efficient use without building for the long-term is an incomplete strategy.

Oil-Independent, Carbon-Independent Infrastructure:

See Drake et. al. for a slightly different more detailed proposal

- Double or multi-tracking the US rail system on all but low traffic lines enabling consistent speeds of 110 mph on non-high speed lines for freight and passenger trains.

- Stepwise electrification of rail infrastructure to 100% electric traction.

- Building on an accelerated basis dedicated high speed rail lines per the US HSR Association’s recommendation: http://www.ushsr.com/hsrnetwork.html

- Electrification of 80% of government vehicle fleets using a variety of battery charging technologies including trickle charge, rapid-charge and battery exchange technologies.

- Extended tax incentives for corporate vehicle fleet conversion to battery power or for plug-in hybrids.

- Rapid build-out of a super-grid supportive of renewable energy development throughout the US.

- A robust regime of incentives for renewable energy development (advanced feed in tariffs based on cost recovery plus reasonable profit with descending incentives for projects in later years).

- Electrification of high traffic bus routes via either trolleybuses or streetcars.

- Build out of light rail and regional rail networks to interconnect high and medium density cities and suburbs.

- Corporate tax credits for build-out of tele-presence (e.g. Cisco’s product here) technologies and to encourage tele-commuting and tele-meeting

While technologies could evolve in the future that might alter the relative proportions in the above plan, these policy proposals and programs rely on technologies that are available today, some of them with a track-record of over a century. However, the goal of getting off oil, let alone fossil fuels has not been a priority of US industrial development and government policy, so our rail and transport networks have remained dependent on the happenstance of oil extraction and the oil markets.

Substantial and Insubstantial Hurdles that Delay Us

If our country does not first slide into a state of permanent second or third-class status, it is inevitable that we in the US will move to a post-oil, post-carbon transport system incorporating most of the largely electric-drive technologies listed above. However this should not lull our current leadership into complacency or half-measures, because sliding into a state of decay and dependency is a distinct possibility. Will Obama be the President to lead us there, as Eisenhower was the President who built the Interstates? Or will he be the President who excited hope, talked a good game but gave too much discretion to fossil fuel interests? We can be the last nation in the world to wean ourselves off oil, massively in debt, and always be in the position of borrowing know-how from others or we can start to move “on our own power” towards a position of leadership in this area.

The current Senate climate bill sees most of what is proposed above as distant pipe dreams rather than near future realities. Most of the electric vehicle provisions in it are termed “pilot programs” with greater favor shown to natural gas vehicles and mild oversight for unconventional natural gas extraction. Public transportation and rails are given little or no mention.

Leadership will be required to push ahead to the solutions based on what is already known about the physics and technology of transport and energy, instead of stopping at the half-way measures or the dead-end technologies that depend on fossil fuels. True leadership involves anticipating and overcoming hurdles. I have listed below the main hurdles which present themselves to whomever, I hope President Obama, decides to place the American economy on a sustainable energy basis.

Hurdle #1: Market Idealization (Market Fundamentalism) Vs. Planning

One of the greatest hurdles is the ongoing influence of market idealization (or “market fundamentalism“) in Washington in general, on both sides of the aisle in Congress and in the White House. In the era of market idealization over the last 30 years, planning, especially government planning, got a bad name as markets were supposed to constitute all of economic life as well as being perfect and complete economic institutions. Through his sojourn at the University of Chicago, one of the centers of market idealization, President Obama was exposed to an environment that celebrated a view of markets as self-sufficient, self-regulating institutions which perhaps continues to color his view of planning and government’s role.

The use of “cap” legislation, carbon pricing, or emissions targets does not substitute for planning because such unspecified “plans” to achieve quantities of emissions reductions cannot substitute for the sequence of timed and specified actions that constitute a plan. Emissions caps or targets suggest that the market will find its way without planning. In some areas this works better than planning but in transportation and energy infrastructure, not so much.

Some major problems with markets are that they don’t price in future risks or distant future rewards very well in many sectors, including energy and transport, and, when unregulated, tend to focus market participants on their most immediate concerns. Markets also do not produce all the conditions for their own survival and continued profitability. Governments have historically stepped in to provide people and markets with structure for transactions that threaten to undermine trust between market actors. Additionally, governments of most nations with complex economies provide public goods like infrastructure that enable longer term social and economic goals of both private and public actors to be achieved. While market-like institutions can be imposed upon the “natural” monopolies of the electricity and the rail businesses, these market reforms do not generally orient these businesses to rapidly change their infrastructure but rather focus them on squeezing value out of existing assets.

Planning can originate from private and non-profit actors as well as from government though this does not release governments from the duty to initiate or help structure plans that effect diverse sets of stakeholders. The Desertec Initiative is an example of a large-scale international energy plan that has originated in the private and non-profit sectors. The Desertec Foundation and the Desertec Industrial Initiative (DII) are working on building a renewable energy supergrid that spans Europe, North Africa and the Middle East in order to provide renewable electrical power to the area, balancing wind and solar resources across the region. Munich Re, a large re-insurance company based in Germany, concerned about environmental and climate risk in the future and along with a consortium of electrical utilities and technology companies, including Siemens, ABB, Abengoa, MAN Solar Millennium has created the DII. Whether the impulse to plan has come from the private sector or from government, government needs to be involved in making sure that large scale energy and transportation plans serve national interests and are executed and financed in a transparent and fair manner.

As market idealization has been also a particularly fervent form of anti-Communism, government involvement in planning has been associated in the minds of US politicians and sections of the public over the past 30 years with centrally-planned Communist economies. Due to these still largely unchallenged views of market idealists, politicians making the argument for planning will need to run the political gauntlet of being accused of being a Communist (or, as is common in the precincts of the Tea Party and Fox News, a fascist). Unfortunately, academic economists too have also been lax in making the case for government planning beyond Left-Right ideology. Republicans and Democratic Presidents and other government officials between 1940 and 1980 did not generally have to justify their use of planning but since 1980, planners and planning advocates have needed to keep a low profile.

So presenting a full-on Oil-Independence Plan from the side of government would present the President with either having to make a two-stage argument (first for a role for planning and then for the plan) or to compress the two together in one artful package. The latter is not inconceivable but, our President, so far, has shown more interest in pointing out how much he has in common with the Republican Party that has been almost completely captured by market idealists.

On the other hand, almost everybody in contemporary American politics is for energy independence and national defense. It is not a stretch to imagine our centrist to right-leaning Democratic President reaching across the aisle to push for a “Oil Independence Transportation Plan”. This would require preparation, research and political leadership by the President, the Administration and Congress but is eminently do-able. Thus a brilliant and principled politician, maybe even our current President, could present this plan as a combined act of patriotism and long-term economic good sense.

Hurdle #2: Deficit Worries and Hysteria

Given that we are in an economic downturn and tax revenues will not be able to be boosted substantially, a post-oil transport infrastructure built in a timely manner will probably involve deficit spending. Some parts of this system can be built and financed privately and paid back via user fees while others will have the status of public goods, like roads, that will need to paid for via taxes and or potentially inflationary deficit spending, i.e. printing money.

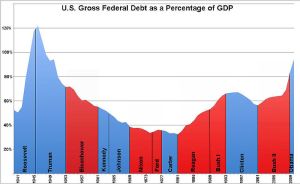

We have been facing a rise in public debt and budget deficits over the course of the Bush administration and the first part of the Obama Administration. The current level of the public debt stands at approximately 60% of its maximum in relationship to GDP at the end of WWII (108%). Misinformed politicians, pundits, and financiers take this as an occasion to stir hysteria that is stoked by a combination of fabrications and partial truths about the potential impact of budget deficits on the American economy. Economists, such as Paul Krugman, Dean Baker and Joe Stiglitz, who have studied economic history and effects of deficit spending on jumpstarting the economy, have attempted to correct these misguided views of deficit spending in the context of a severe economic downturn.

This graph of the "gross" and not the usually cited public debt (now at 67%) indicates that excluding the first year of the Obama Administration the last four Democratic Presidents reduced the gross federal debt while the last four Republican Presidents increased it relative to GDP. In general, economic depressions and wars tend to increase the federal budget deficit.

Deficit hysteria seems to have a strong political component to it, as these fears remained largely dormant in the Republican Administrations that have run up large debts in the past. As a preventative, those who are opposed to a strong government role in the domestic economy (though generally not to military adventures) have attempted to intimidate the President and others by warning of runaway budget deficits. There are now some more severe budget problems in other countries (Greece for instance) and the differences between the US situation and these countries are played down to intimidate those who would want to spend deficits on building US domestic economic growth.

While those who stir deficit hysteria tend to be closed-lipped about their large-scale political and economic agenda, they generally are opponents of all government-provided social services and government-led economic initiatives preferring to reserve these functions for private enterprise. Deficit hysteria implies the idealization of markets, though is a more sophisticated variety that acknowledges that there is “some” role for government, only to minimize that role in every proposal, due to fear of budget deficits. Unfortunately President Obama has some vulnerability to deficit hysteria, in that he has not come out vigorously in defense of government’s role in the domestic economy, preferring instead to adopt an attitude of compromise and conciliation with people who talk as if there is no legitimate role for government social programs or in the domestic economy.

While budget deficits need to be monitored closely, the US has luckily somewhat more flexibility than many other countries to engage in deficit spending. A very strong case can be made that deficit spending to help finance a post-oil transportation infrastructure is a very good use of public funds and also shows nations that hold our debt that we are spending in ways that will improve our overall competitiveness and resilience as a nation. Deficit spending in this way actually works to reduce our trade deficit which is in most years larger than our budget deficit and largely attributable to oil imports.

Hurdle #3: Balancing the Interests of Stakeholders, Mix of Private and Public Enterprise

The French SNCF is a public benefit corporation that runs and owns the French trains and stations. In order to open up the rails to competition the rails and rights of way are owned by another government-owned company, the RFF, enabling, theoretically, private train companies to compete with SNCF on the same tracks. (Photo: Wikimedia Commons)

An Oil- and Carbon-Independence Plan will require the participation of a number of stakeholders some of whom will be less than enthusiastic participants in this ambitious effort. The railways in the US are ambivalent about the ambitious plans of advocates for either high-speed rail or electrification. Like other large infrastructure-dependent businesses, these usually risk-averse corporations make money by squeezing value out of their existing infrastructure and sticking to decades-long incremental capital investment strategies. Additionally, and ironically, railways, our cleanest and most efficient means of transporting freight even with diesel traction, haul the dirtiest fuel, coal, to power plants of the large coal-burning utilities; the largest source of revenue for railways is coal transport accounting for 21% of 2007 revenue with intermodal (container) being the fastest growing segment.

Left to themselves, the US freight railways would not be able to undertake nor necessarily see it in their short or medium-term interest to electrify their railroads nor embark on a massive program of track build-out. The railways are in favor of tax incentives to help them continue capital improvements but these alone will probably be not enough to double and triple track mileage. The railways own their own rights of way and are currently entirely self-funding and compete largely on price and capacity with other freight modalities. In order for massive public investment to be possible, the railways would have to develop an entirely different relationship with the federal government.

If they were intent on executing a Post-Oil transport plan, policymakers would need to lead the railways into a new relationship or perhaps buy some of them out, in part or in full. The massive level of public investment required to enable the railways to carry triple the freight plus 20 to 30 times the passenger volume would transform their capital base with largely public funds or public guarantees to be able to undertake the risk. Such action would require a combination of vision, leadership and negotiation skills from the side of government.

As diesel locomotion (actually diesel-electric) is still a very efficient method of hauling freight and passengers relative to other modes of transportation, the transition to an Oil-Independent infrastructure could be achieved in two stages: first railway track build-outs that are electricity-ready and then the electrification of those railroads as a separate project.

An alternate route towards oil-independent transport is possible that “deals in” the trucking industry but requires the adaptation of several existing technologies and an alteration to the interstate system: Using hybrid dual-mode trolley long-distance trucks on dedicated lanes of the interstate that also have a backup generator or battery pack that enable easy on and off and grid-detached travel. There are no technological breakthroughs required to do this but it needs the backing of a government or government-funded research program that seriously studies electrification of lanes of interstates and the high speed attachment and detachment of trolley poles or pantographs to overhead lines.

Designing and executing an Oil- and Carbon-Independence Transport and Energy Plan would also not necessarily inspire the other large conservative infrastructure-based companies, the power utilities, to join in the spirit of the enterprise. Similarly to the freight railways, utilities wring value from a decades-old infrastructure and generally adopt change very slowly. Particularly challenging for many US utilities is a transition away from coal which accounts for approximately 50% of electricity generated in the US. Selling electricity to railways may be an additional source of revenue but also would involve new infrastructure and might require new generation, which would need to be low- or zero-carbon. A portion of the electricity demand from railways may be supplied by federal power generation facilities, perhaps by a newly founded Railways Power Administration, modeled on the Western Area Power Administration or similar. Passenger railway power demand would require daytime generation which would coincide with solar but freight would add to baseload demand as it would operate around the clock.

A clear expression of purpose and demonstration of intent by government leaders to reduce oil demand in the US is a prerequisite for successful negotiation with stakeholders in shaping the post-oil future. So far the President and Congressional leaders haven’t shown the guts and independence of mind to work this out with industry stakeholders.

Hurdle #4: Many Americans’ Love of Expansive Resource Use (and Disregarding the Consequences)

Different cultures tend to have differing attitudes towards the material world and what is considered attractive or desirable in the use of resources. In Japan, with one of the world’s highest population densities, cultural preferences include a focus on small, sometimes intricate objects. Traditional agriculture in China is highly space- and resource-efficient. In Europe, culture has emerged from similar resource constraints, for which it is much admired throughout the world. In the US, we have through a large portion of our early history, not had to deal with as many resource constraints, including a belief that more abundance is always around the next bend. Europeans came here in search of “El Dorado” and we have had the tendency to believe in “Virgin Land”, either physically or virtually, into which we could move if we “messed up” or wanted to leave our original physical context.

President Jimmy Carter wore a cardigan in some TV addresses to show that he was practicing energy conservation during the winter at the White House. Even though he was presenting Americans with a prudent message, in hindsight with the triumph of Reaganism and reactive resource- and energy-profligacy, our image-obsessed culture has held onto Carter's slight awkwardness, school-teacherly manner and absence of swaggering machismo rather than the content of his message.

The electoral defeat of Jimmy Carter in 1980 by Ronald Reagan and the subsequent growth of a culture of reactive anti-environmentalism has impressed politicians with the dangers of appearing to “wear the cardigan” rather than use resources “like you just don’t care”, yielding a culture of reactive or revived profligacy. Contrarian anti-environmentalism both on the Right and in the apolitical Center has meant a return for many to the energy and material use patterns with which Americans grew up until the 1973 OPEC Oil embargo. Because of the political defeat of Carter (for a number of reasons), the 1985-2001 return of cheap oil, and the 2001-2009 Bush Presidency, few politicians have attempted to experiment with what is possible in the way of communicating a stance that counsels wise use of resources while retaining a sense of American identity.

Obviously, we will need leaders to set an example and attempt once again to join the American spirit with an awareness of the earth’s limits and wise use of resources. Expansive plans to create a post-oil infrastructure can be combined with measures that suggest that the America of the future will not lay waste to the earth. The ability to break up the cultural “forced choice” between abstemiousness versus expansiveness will involve creativity on the part of political and cultural leaders. Whether the Obama Administration is up to the task and has the will to engage in this vital transition to a new kind of American identity remains to be seen.

Hurdle #5: The Biofuels Distraction

A few years ago, using biofuels as an oil substitute were treated seriously by some environmentalists and became a big favorite of politically powerful agricultural lobbies. Since then, it has dawned on most of the environmental movement plus more and more policymakers that biofuels are a poor source of fuel and environmentally may be under many conditions worse than using oil. The net energy yield, plus land use, plus water use put into making ethanol or biodiesel from dedicated crops rather than waste products turns out to be a net negative for the environment and economically disruptive for food production. To produce mechanical energy from sunlight it is far more advantageous to erect solar panels or use wind turbines in agriculturally marginal areas, which would occupy far less space, have far lower environmental impact, and produce far more energy.

Unfortunately, in the American heartland, it is difficult, in the absence of renewable electricity policy that is attractive to farmers and higher prices for food crops, to turn away from support for biofuels and the overproduction of corn for that purpose. While perhaps research may turn up a more sustainable biofuel, a strategy based on biomass production for biofuels other than as a subsidy to farmers is unjustified. There may in the future be niche uses for some future biofuel process but these will not serve the vast energy demand currently served by oil. A gradual shift to a sustainable agriculture policy that addresses the economic concerns of farmers without continuing our unsustainable corn policy would be the long-term solution.

As an immediate strategy, the policymakers would need simply to slowly back away from biofuel subsidies, while a compelling and well-explained alternative for farmers and farm-belt politicians is developed.

Hurdle #6: Corporate Funding of and Influence in American Politics

A recurrent theme throughout the last year and half of reform attempts has been the notable influence of incumbent industries and their lobbyists in influencing politicians in Washington of both parties. While there are many corporations that stand to benefit from an Oil- and Carbon-Independence Plan, these have not yet made common cause and many see their short-term interest in the energy and transport status quo.

The likelihood of formulation and implementation of a plan with the longer term interests of the US in mind, would be greater with corporate money taken out of politics to a very large degree, as then lobbyists would more likely to be seen as advisors and industry representatives rather than represent the co-“employers” of legislators. This is not to say that there aren’t politicians who bravely stand up now for the long-term view of what is best for the overall American economy. It can only be hoped that more politicians show this type of courage on a number of policy fronts and, as well, in the service of campaign finance reform.

Are There Any Other Options?

Those who read these recommendations with a jaundiced eye may say: “You expect too much from government” or “this will never happen”.

My response: Short of the United States slumping into further energy dependency, accelerated trade deficits, inflation due to spiraling oil prices and accelerated climate change worldwide, what are the other options?

If you have another workable option please share it with me or, better yet, the Administration and the world.

Standing on the side of the fishermen and the wildlife of the Gulf is not an act of excessive and unrealistic belief in human goodness, an underestimation of our energy demand, or an exaggeration of the sensitivity of natural systems. It is simply the recognition of the unwinding of a model of economic and energy development that has run its course.

Just Published on Grist: Piece on “Bill Gates and Our Innovation Addiction” March 3, 2010

Posted by Michael Hoexter in Climate Policy, Energy Policy, Renewable Energy, Sustainable Thinking, Uncategorized.Tags: Climate Policy, Energy Policy, Renewable Energy, Solar Energy

add a comment

The environmental news site Grist, has just published a piece I wrote that is a response to Bill Gates’ recent entry into the climate and energy discussion.

Check it out at:

Enjoy and comment if you like!

Michael

My New Post/Article on Post-Copenhagen Ethics March 3, 2010

Posted by Michael Hoexter in Climate Policy, Efficiency/Conservation, Energy Policy, Green Activism, Renewable Energy, Sustainable Thinking.Tags: Carbon Pricing, carbon tax, Climate Policy, Energy Policy, Renewable Energy, Solar Energy, Sustainability

add a comment

Frustrated with the state of climate action both here in the US and at the COP15 meeting in December, I have been focusing on how to distill thinking about climate action to some simple rules. I came up with a longer piece that builds on the work of Donald Brown at the Climate Ethics Center at Penn State University.

Since this is a long piece I have posted it in my “Energy and Transport Policy” section as a three part post starting from this page :

http://greenthoughts.us/policy/post-copenhagen/

I also have a PDF version here, which some may find easier to read or refer to.

Please read and comment!

Michael

Cap and Trade: An Unserious Policy Framework for Humanity’s Most Serious Challenge – Part 1 December 12, 2009

Posted by Michael Hoexter in Energy Policy, Sustainable Thinking.Tags: cap and trade, Carbon Pricing, carbon tax, Climate Policy, COP15, Energy Policy

4 comments

In a few days in Copenhagen, world leaders will debate and, we hope, agree upon aggressive targets for humanity’s greatest challenge to date: to avert devastating man-made climate change by transforming our economies’ use of energy and of land while maintaining and improving social welfare for the world’s peoples. We have in the past 250 years proceeded on a course of development which has used fossil energy to replace human and animal muscle power with mechanical energy. Economic development has almost become defined by application of this “exosomatic” energy, 85% of which comes from fossil sources worldwide. Emissions from fossil energy as well as changes in land use, have dramatically increased the concentration of warming gases in the atmosphere, leading to increases in average annual temperature. Furthermore, preferences for eating meat, in particular beef and bovine products like milk, have contributed massive amounts of warming potential to the atmosphere. Finally, combustion of biomass and many fossil fuels has produced black carbon which has contributed substantially to warming. Balancing the living standards of human beings with the health of the planet has become an unenviably massive set of tasks.

The potential economic and ecological catastrophes from a warmer planet are starting to become clear to us. The retreat and eventual disappearance of glaciers seems now highly likely, reducing fresh water supplies for billions of earth’s people. Rising sea levels from the melting of polar ice caps will swamp hundreds of millions more who live in low-lying coastal areas. Changes in temperature are already disrupting fragile ecosystems with, for instance in North America, the pine beetle now surviving what once were frigid winters and devastating the forests of the Western US and Canada. Many of the species with which our species has co-evolved will die off in a warmer world.

However, when compared to the magnitude of the threat and the measures needed to meet or exceed intended targets, the instrument chosen during the 1990’s to transform our economies, cap and trade (also known as emissions trading), has proved to be marginally effective to ineffective and extremely cumbersome to implement. It is as if you, with great fanfare and concern, pointed out that there was a drowning swimmer 100 feet away from you but chose to throw a rubber duck instead of a lifebuoy to save them. With time running low, it would be a disaster if government ministers and world leaders lock themselves into the cap and trade instrument as the main means to achieve emissions reductions targets. Cap and trade or emissions trading, has had unimpressive results when compared with more traditional “command and control” regulation in the area of acid-rain forming pollution (SOx) and seems to have been selected as a means to control greenhouse gases largely because it appeared at the time politically expedient to the then-Clinton Administration. This was humanity’s “first go” at a climate policy and the instrument has shown more weakness than strength.

There was within the Clinton Administration, which has had an outsized influence upon the shape of our first climate policy framework, an openness and vulnerability to the anti-regulatory and anti-tax rhetoric issuing from the Republican Party post-Ronald Reagan, so cap and trade seemed like an elegant domestic political solution. Clinton, with apparent enthusiasm, declared in 1996 that “the era of Big Government is over,” yet government action and government regulation of markets, as it turns out, are going to be the pivotal institutions in transforming our economies to radically cut emissions (and managing our way out of the Great Recession). Furthermore the Clinton Administration had more generally a fascination with financial innovation via expanding the influence and reach of financial trading markets and loosening regulations upon them.

However, in its capacity of creating a politically acceptable alternative to direct government action in the economy or to the levying of Pigovian (“sin”) taxation on carbon emissions, the proposal to use cap and trade to regulate greenhouse gas emissions has been, in the United States, a miserable political failure. Opponents of action on climate change have seen through or willfully misinterpreted cap and trade’s “soft” regulatory image. They are reinforced in their belief that “government is bad” by the effort by their political opponents to hide or make indirect government’s role via cap and trade. “Fancy footwork” was unfortunately a hallmark of the Clinton Administration’s major policy efforts and cap and trade’s application to global warming is no exception.

I have elsewhere outlined two policy frameworks that with greater certainty would cut emissions more rapidly, based on more robust, reality-based economic and social scientific principles. Firstly, a carbon tax or fee will function as a much clearer, more consistent incentive to invest in mitigation because of its predictability and clearer price signal to investors and consumers. If paired with a series of targeted incentives for clean energy (feed in tariffs or other performance-based clean energy incentives) and investment in energy and transport infrastructure (electric transmission, electrified rail, electric vehicle infrastructure), we will see measurable emissions reductions and the emergence of real market choices upon which carbon prices will act. The combination of incentives, disincentives and public investment might be called a “Comprehensive Climate and Energy Policy”. Alternatively, a series of 20 to 50 large scale regional and global emissions cutting projects can form the basis for determining what would be the unifying national and international policy instruments, most likely including a carbon tax of some form. Projects would need to represent certain emissions reductions using existing or emerging technologies within a timeframe or directly enable emissions reductions (transmission to renewable energy zones, electrified rail).

An alternate “meta-economic” framework for effective climate policy is Keynesianism, which after 3 decades of disregard has once again been recognized as the vital guide to economic policy at times of crisis. What I call “Climate Keynesianism” recognizes the key role of government in leading an economy in crisis, in this case one with both a traditional worldwide economic slump in combination with an ecological crisis of unprecedented proportions. Most commentators calling for a WWII style mobilization to catalyze economic growth and a greening of our society (a “Green New Deal”) are working with assumptions based on the work of John Maynard Keynes, though not all acknowledge his contribution. Within a Keynesian framework government planning can supplement and support markets rather than remain invisible in our guiding economic theory or remain foolishly dismissed, as it has been over the past 30 years. I have recently ventured the hypothesis that most intentional emissions reductions or increases in the efficient use of polluting resources that have occurred in our history have been the product of the implementation of government programs inclusive of the design of tax policy.

Furthermore, as I have argued here, cap and trade shields polluters and government from the ethical pressure of concerned citizens and concerned scientists, which are, in the end, the prime motive forces of climate action. The new property rights to pollute that are the basis of emissions trading are fairly non-transparent and insulate polluters from the need to maximize emissions cuts sooner rather than later. Cap and trade, in its implementation rather than in the ideal terms in which some advocates discuss it, sends out “go slow” or inconsistent signals via its complexity, reliance on offsets of often poor quality, soft targets, introduction of non-essential players into the domain of emissions reductions, and the contract not to cut emissions to zero contained within a pollution permit.

Seriousness and Unseriousness

I have above sketched out in broad terms why cap and trade is ineffective and incommensurate to the task of carbon mitigation (elsewhere I have gone into more detail with supporting documentation about why cap and trade is ineffective and resists strengthening). However these criticisms that I have made are not particularly arcane or difficult to arrive at…why is it that these views are not shared more widely? If we leave aside self-interested calculation for the time being, I believe there is what might be described as a “reality-orientation” among policymakers and important economic actors, within which cap and trade appears to be a quite acceptable solution despite its “Rube Goldberg” nature and inappropriateness to the task. This reality orientation shapes perceptions of what is the nature of the challenges facing us and what are acceptable solutions to those challenges. I would contend that it is possible to judge with some accuracy that some solutions are “serious” and others “unserious”.

On its simplest level, seriousness is an orientation of mind, either temporary or longer term, where we clear away irrelevant facts, irrelevant emotional states, and irrelevant impulses from consideration because of the need to take action. Seriousness means focusing on only the relevant information for a particular moment or challenge and allowing in new information that is also relevant. Seriousness means being able to screen information based on its appropriateness to what needs to be done now or very soon; it means understanding the links between an action and its ultimate purpose.

Despite the immediacy-of-action requirement in serious situations, seriousness however might also involve engaging in long-term planning, considering many factors and facts, but nesting and ranking them as to their relative importance, even though first actions are very important. The observation from the study of complex systems called “sensitivity to initial conditions” a.k.a. “the Butterfly Effect” explains to some degree why first steps are important even though the road may be long. The planning and building of large physical structures requires seriousness from the outset to the end of the building process and beyond. Seriousness most often involves the use of rational thought processes to come to solutions based on the relevant information, though intuitive, “Blink” type, reactions in extremis may yield good results as well.

Another way to look at seriousness from a more biological perspective, is that it is the “fight or flight response” brought under the control of the prefrontal cortex, the center of our brains that is associated with impulse control, deliberation and planning. The fight or flight response is our basic physical and emotional response to threats, which has analogues across multiple species and has evolved over hundreds of millions of years. In serious states of mind, the anxieties and dangers that trigger that response are anticipated, and planning is initiated that will reduce the likelihood of our encountering those threatening situations.

Unseriousness by contrast is allowing extraneous concerns and facts into that emergency or near-emergency situation or relying largely on non-rational decision-making processes when time would allow for rational ones. As seriousness is judged by context and we all have multiple commitments in our lives, some people argue over whether people are “truly” committed to the issue at hand or are using it to further their “other agenda” to which it is assumed they are more committed. As an example, deniers of climate change or action on climate change are in effect accusing those who are concerned about climate change of unseriousness because they believe them to have invented climate change science as part of a pre-existing political agenda. For these people, the pre-existing political conflict (between Left and Right) is the serious part while the science, to them, is unserious. In this dispute there is a disagreement about which here is the fundamental context upon which to establish true “seriousness”: the physical world as observed by science or the political and subjective world of human beings.

As “unseriousness” carries with it a pejorative tone, it is not the same thing as “lack of seriousness” in most domains of life where humor and levity is highly valued. To break up the repetition in this piece I will use “lack of seriousness” to mean “unseriousness” because of the context. However “to fiddle while Rome burns” can rightfully be called unserious, with all pejorative meanings intended.

To judge someone or something as “serious” or “unserious” appears at first to be a subjective task. What are extraneous or irrelevant concerns and impulses? What are rational thought processes? For instance, I could be deciding at this moment for personal reasons of my own to declare cap and trade to be “unserious” and carbon taxation, a Comprehensive Climate and Energy Policy, and Climate Keynesianism to be “serious”. Or seriousness could just be a state of mind that comes and goes; I might have a personal preference for serious people or a mood of seriousness (as it turns out this is the not the case). If one looks or sounds a certain way, one might think, one is or is not taken as “serious”.

However I believe that most readers will be able to agree that certain facts and events in the world are “serious” without reference to the accompanying facial expressions or tones of voice. What do we mean by “serious” or when something “gets serious”? When something is “serious” we realize that we have either very little or no choice in an important matter; when something “gets serious” options have been removed and, yet action on our part is required that will have substantial repercussions for us and/or for others. What most people would consider “necessities of life” are almost by definition “serious” while wants are not necessarily “serious”. Government is often though not always involved in “serious” life and death situations: fire departments, police departments, courts, national defense etc. Climate change is one of those serious issues: we cannot escape the world en masse and we are degrading the biosphere irreversibly through our activity. I am not making up its seriousness nor am I exaggerating it: it is matter of humanity being able to live decently or the potential for a much reduced existence for humans and coevolved species in the future.

Also, many people, though perhaps a lesser number, will be able to identify unseriousness in the response to a serious situation. You might become impatient if you recognize a serious predicament but are being offered information or solutions that are in some way irrelevant to its resolution. If we are led to believe that we are in an emergency, yet are then offered a solution that is not effective or seems to be an answer to a different question, we need some very strong reasons to pair “Question and Answer A” with “Question and Answer B”. However, as noted above, in some serious matters there are disputes about what is the “ultimate ground” or context against which acts are judged as more or less relevant: are politics and human relations or is the biophysical world “the ultimate ground”?